Buying a slice of paradise in Barbados might seem like a dream reserved only for the privileged few. However, the process is surprisingly accessible and straightforward. Foreigners can own property without the typical red tape encountered in other countries. With no restrictions on ownership, the island is a beacon for international buyers seeking a tropical escape or an investment opportunity. Let’s explore how this Caribbean gem opens its doors to foreign investors and what you need to know before diving in.

Why Barbados?

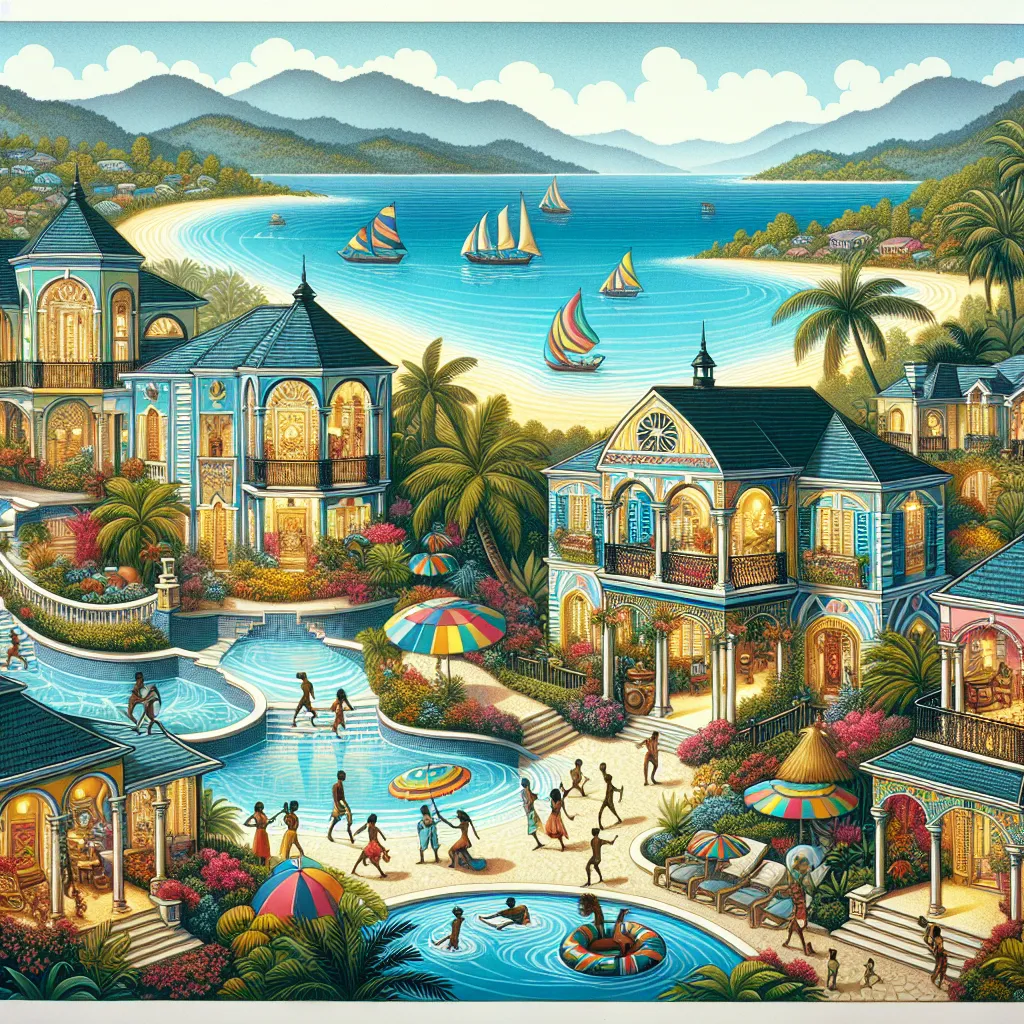

Barbados, with its stunning beaches and vibrant culture, offers a unique blend of relaxation and investment potential. The real estate market here is diverse, ranging from luxurious beachfront villas to affordable apartments. But why should you consider investing here?

-

No Ownership Restrictions: Unlike many countries, Barbados doesn’t impose restrictions on foreign property ownership. This ease of access makes it an attractive option for international buyers.

-

Stable Economy: Barbados has a stable political and economic climate, reassuring investors of its long-term viability.

-

High Rental Yield: The consistent influx of tourists ensures a high demand for rental properties, making it a lucrative option for holiday rentals.

The Buying Process Simplified

1. Secure a Local Attorney

Engaging a local attorney is crucial. In Barbados, conveyancing attorneys handle the legal intricacies of property transactions. They ensure that all legal requirements are met and that the transfer process is seamless.

2. Currency and Financing

Foreign buyers are required to bring in funds from outside Barbados. Arranging for foreign currency early is advisable to avoid delays. Local banks do offer mortgages to foreign nationals, albeit a substantial deposit (usually 30-40%) is required.

3. Legal Steps and Documentation

- Offer and Agreement: Start by making a verbal offer. Once accepted, this is formalized in writing.

- Deposit Payment: A 10% deposit is typically required four weeks prior to the exchange of contracts.

- Conveyancing Process: Your attorney will conduct a title search and prepare necessary documents to ensure a clear title transfer.

- Registering the Title: Upon completion, the property is registered in your name with the Land Registry.

Financial Considerations and Taxes

Understanding the Costs

Owning property in Barbados comes with costs beyond the purchase price. Here’s a breakdown:

| Cost Type | Percentage/Amount |

|---|---|

| Property Transfer Tax | 2.5% of purchase price |

| Stamp Duty | 1% of purchase price |

| Legal Fees | 1-2.5% of purchase price |

| Annual Land Tax | Based on property value |

Rental Income Potential

Owning a property in Barbados provides opportunities for rental income, especially in peak tourist seasons. Owners can manage rentals directly or leverage resort management services.

Where to Buy?

Hotspots for Property Buyers

- West Coast: Known as the “Platinum Coast,” it’s famous for luxury villas and high-end amenities.

- South Coast: Offers a mix of residential and commercial properties, with vibrant nightlife and beautiful beaches.

- Royal Westmoreland: A private, gated community offering full or fractional ownership with world-class amenities.

Final Thoughts on Buying Property in Barbados

Barbados is more than just an investment; it’s a lifestyle choice. The island offers a chance to own a piece of paradise, engage with a rich culture, and enjoy a warm, welcoming community. While the process is straightforward, partnering with a local attorney ensures all legalities are handled smoothly. AnySqft provides AI-driven insights that make navigating the Barbados real estate market even easier, connecting buyers with opportunities that match their needs.

In summary, the dream of owning property in Barbados is within reach for foreigners. With its no-restriction policy and stable environment, it’s a sound choice for those looking to invest in a tropical paradise. Whether you’re after a personal retreat or a rental income generator, Barbados offers it all with a touch of Bajan charm.

Can foreigners buy property in Barbados?

Yes, foreigners can buy property in Barbados without restrictions! Here are key points to consider:

- No Citizenship Required: Non-residents can purchase property just like local citizens.

- Legal Assistance: Engage a local attorney for a smooth transaction.

- Financing Options: Mortgages are available for non-residents, typically requiring a 30-40% deposit.

Benefits of Buying in Barbados

- Investment Potential: High rental yields due to tourism.

- Beautiful Locations: Options range from beachfront villas to luxurious condos.

Explore your options with AnySqft for a seamless property buying experience. Get started today!